The #1 debt management software, handling all credit and receivable types, from early collections to legal processes and recoveries.

Trusted by

QUALCO Collections & Recoveries (QCR) efficiently streamlines operations, manages NPLs, and handles all receivable types with a digital-first approach, guaranteeing a seamless experience whether integrated into a banking ecosystem or used as a standalone system of record.

Cash flow increase

Realise quick ROI by centralising, automating, and eliminating manual work

More Cases Handled

Combine segmentation and strategy design with real-time data and full control

Overall Satisfaction

QCR boasts a stellar 4.5 out of 5 star rating for client satisfaction

We are happy to take the next step in choosing QUALCO technology and creating the world's largest debt-servicing

Harry Vranjes

former COO

Working with QUALCO ensures achieving our business goals and improving customer experience

Mr Pierluca Bottone

CEO

Implementing QUALCO Collections & Recoveries acts as business growth enabler for Cabot Portugal

Ms Susan Catraia

Head of Operations

Next-Gen Features Guarantee Maximised Recoveries

Omnichannel Collections

Boost customer engagement and payment rates using conversational messaging, automated bots, live agents, and payment processing functionalities.

DIGITAL SELF - SERVICE PORTAL

Offer customers 24/7 account access, flexible repayment plans, and online transaction monitoring, reducing operational costs and enhancing their experience.

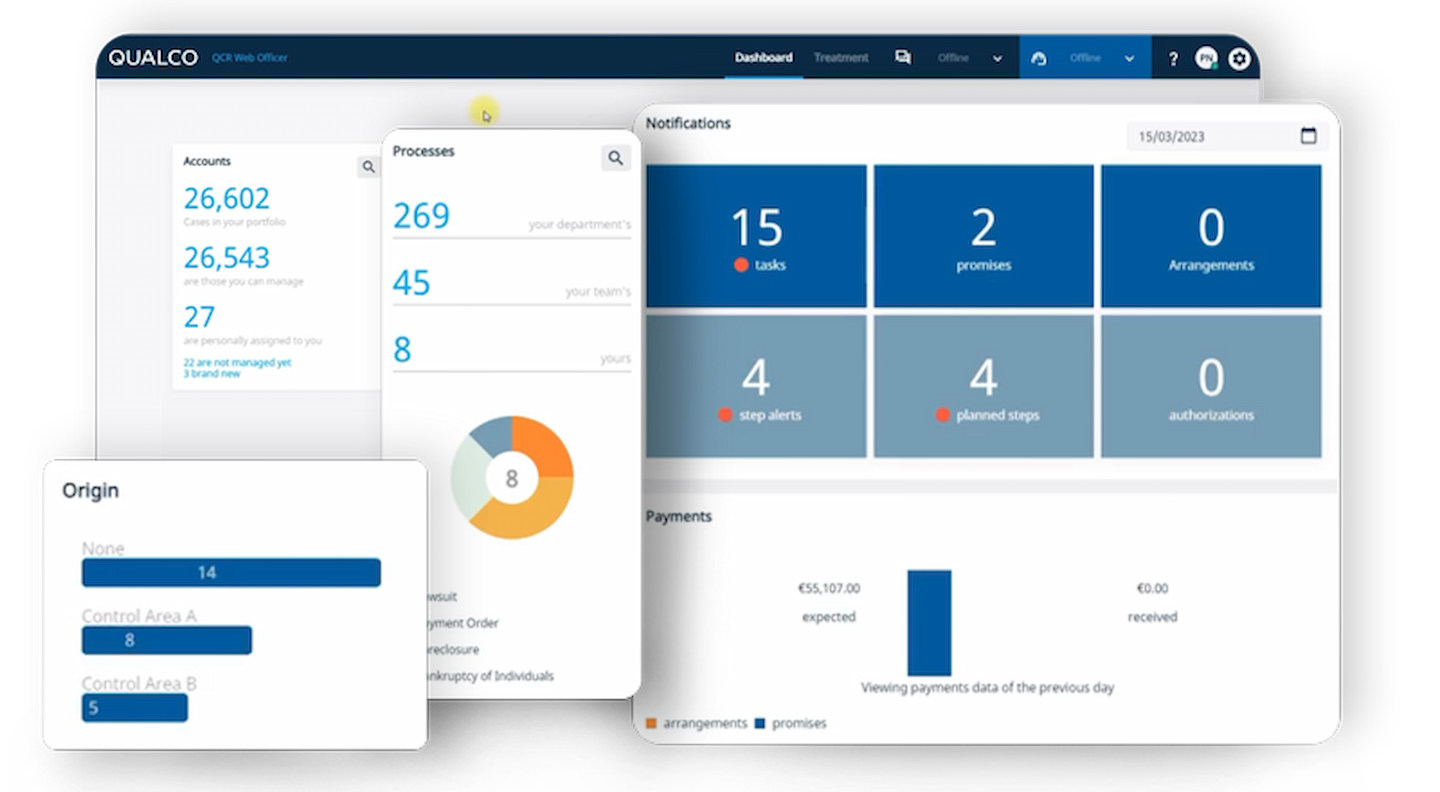

IN-HOUSE COLLECTIONS

Optimise in-house collections with user-friendly interfaces, multi-channel communication engines, and flexible repayment options.

OUTSOURCED COLLECTIONS

Manage external collection activities via automated assignment and recall. Facilitate third-party access and enable system integration and performance monitoring.

DECISION - ENGINE

Improve decision-making with advanced analytics, real-time modifications, and an expandable data hub for tailored customer assessments.

LEGAL MANAGEMENT

Streamline complex legal processes with a modern user interface, customisable process design, expense tracking, progress monitoring and much more.

COLLATERAL & REAL PROPERTIES

Manage collaterals and real properties, capture detailed information such as ownership, rights and valuations and track secured debts.

RESTRUCTURING

Refine your restructuring from product definition to implementation. Reduce manual tasks, mitigate risks, and tailor solutions based on customer affordability.

SYSTEM OF RECORD

Simplify financial management across the customer lifecycle, while offering full balance management and integration with General Ledger or ERP systems.

MIGRATION & INTEGRATION

Integrate your existing infrastructure, minimise manual processes, and reduce operational complexities. Boost efficiency while adhering to strict security standards.

CORPORATE MANAGEMENT

Optimise customer management, from portfolio analysis and risk assessment to asset monitoring. Capture detailed data while offering viable options.

Watch QUALCO Collections & Recoveries in action

Supercharge the implementation of your new collections system with QCR Accelerator, our pre-configured offering for small to medium-sized banks and retail lenders. This cutting-edge and scalable solution guarantees a unified, automated, and cost-efficient approach for efficient early-stage collections.

Interested in what’s new in QUALCO Collections & Recoveries? Uncover new product features, enhancements, technical upgrades, and much more.

“10+2 Key Capabilities of QUALCO Collections & Recoveries” to learn more