Applying advanced analytics to improve cash collection

QUALCO |

What happened when a leading loan servicing organisation looking to optimise its treatment process and increase cash collections decided to leverage enhanced analytics? Our new case study showcases the impact of harnessing predictive analytics into one of our client’s overall collection process and gives a full view of the approach used to achieve significant positive results.

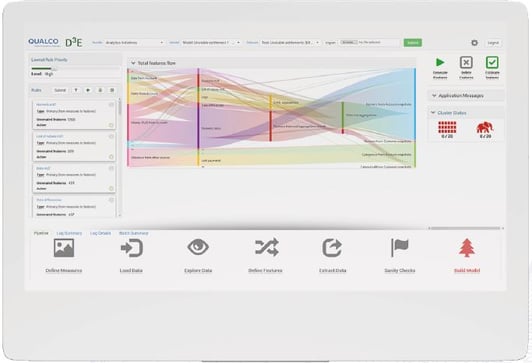

By following our tested approach and employing the powerful data intelligence of QUALCO Data-Driven Decisions Engine, we managed to deliver:

-

7% improvement in cash collections during the first month of deployment, a percentage that is continuously increasing

-

Better roll rates powered by insight driven customer treatment

-

Measurable improvement in treatment outcomes, especially in terms of “unofficial” payment promises

Our structured methodology consists of 5 steps, which can be analysed below:

- Focus

We kick-off by mutually agreeing on the decision point and experimenting with applying analytics.

- Propensity-to-pay Predictive Model

D3E later assigns a predictive propensity-to-pay score to every customer.

- Customer Segmentation

What comes next, is the exchange of all the relevant data variables/scores between D3E and the collections systems to ensure operational actions are fully aligned with predictive model objectives (Actioning as proposed by the model). The segmentation is prioritised on model output and months in arrears (buckets).

- Treatments

The internal collections floor used pre-determined, customised call scripts to conduct settlement negotiations and provide debt management advice to customers. Now activities are perfectly aligned with the model predictions and targeting the desired outcomes.

- Performance Monitoring

Reporting of the strategies against critical and tactical indicators was set in the standard process. In order to assess the methodology we measured call attempts (including dialler attempts), RPCs and treatment effectiveness through treatment status, payments and roll rates.

From all the above, we managed to deliver significant improvements and more specifically:

-

In the first month of the model-based approach deployment we witnessed a 7% improvement in cash collections, mostly coming from low-risk customers.

-

We saw a huge difference in collections between high- and low-risk customers, validating model quality; also visible in RPCs.

-

The contact intensity was affected by multiple factors, but still consistent with the agreed treatment approach, validating adoption.

-

The performance in the test pool up to the midpoint of the month was much better, including better roll rates, indicating targeted treatment accelerates collections.

-

There has been a measurable improvement in treatment outcomes (after customers have exited the model-based treatment steps), especially in terms of “unofficial” payment promises.