Open Banking in debt collections: The data-fueled future is here

QUALCO |

Open Banking has been in the public eye for some time now. Despite the general need for change from the creditor's side, the pandemic played a catalyst role. The increased demand for digitisation acted as an enabler to the Open Banking era. While in its infancy, open banking reached 5 million users in 2022, with a 25% percent increase only from the previous year.

However, open banking isn't just a fancy buzzword; rather than the biggest revolution in the banking industry in the past 50 years. With businesses that manage debt constantly searching for ways to serve their digital customers more efficiently, open banking seems one of the most promising technologies to offer unique experiences.

HOW FAR HAVE WE COME WITH ITS ADOPTION?

With a revenue opportunity of 7.2 billion pounds for 2022, according to PwC, the adoption of open banking has been increasing at different speeds across Europe.

The formalisation of the Payment Services Directive (PSD2) was another reason for its widespread adoption in the region. Some of the leading markets are Germany, Sweden, France, and the Netherlands, where we witness a faster adoption of the technology.

In the absence of a unified adoption framework throughout Europe, the progress has been relatively slow as the implementation occurs at the Member state level. However, the Berlin Group, a group of pan-European open banking ecosystem participants, tries to tackle the issue. After that, the uptake is only likely to ramp up.

HOW DOES IT WORK?

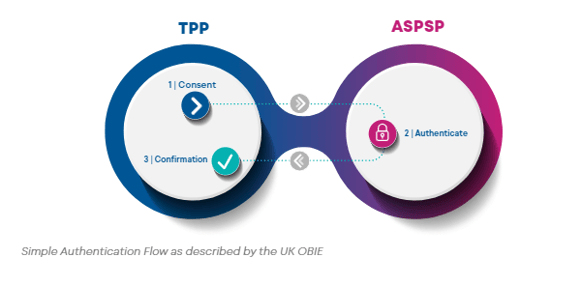

Through open banking, banks allow access to third-party service providers to customers' financial information via Application Programming Interfaces (APIs). This way, they enable third-party providers to shape more tailored services for their customers, and customers from their side enjoy the benefits of the improved offerings.

During information sharing, customers are sharing account and services data. Account data comprised of account holder name (John Smith), account type (Savings), currency (euro) and transaction details (amounts of transactions). After they share this type of information, banks and third-party providers can share information for their offerings with customers. The access to customers' personal information brings the potential to recommend bespoke products and services and easily display them in front of the right customer.

HOW DO BUSINESSES AND CUSTOMERS BENEFIT?

For customers, the new banking era means that they are in more control of their finances and share their data. In practice, the customers are now in the driver's seat in choosing their financial provider since banks are not the only ones who can keep their personal data anymore.

For businesses, customer interaction is far more likely to increase since users will be able to access products and services that respond to their needs. Enhanced customer engagement is the biggest bet, and banking APIs can make it a reality.

Want to discover how Open Banking is linked with your collections function and how it enables faster and safer processes for businesses that manage debt? Read our latest special report Open Banking: Unlocking the Collections Process for more.