How to Choose the Best Collection Software

QUALCO |

Introduction

Debt collection is a complex process that involves several subprocesses such as legal procedures, collateral management, restructuring, and communication strategies. To make this process simpler and more efficient, it is recommended to use collections software, which can provide several benefits. In this blog post, we will explore the key factors that need to be taken into consideration when selecting the best collection software. We will also explore the benefits you can obtain by making the right choice.

Choosing the Best Collection Software

If you're searching for the best collection software for your organization, there are some important parameters and features to consider. These include system integrations, legal management and restructuring tools, comprehensive reporting, collateral management, an automated decision engine, omnichannel customer experience, self-service platform, and a system of record for proper data storage and management. It's crucial to evaluate these factors to make an informed decision.

System Integrations: When selecting a debt collection software, it is important to ensure that it can integrate smoothly with the existing infrastructure. It is essential that the different systems can communicate and exchange data with minimum manual effort, so that you’ll be able to maximise efficiency and performance.

Legal Management and Restructuring Tools: A legal management tool is a crucial component of efficient debt management and collections software as it enables the swift restructuring of complex processes.

Comprehensive Reporting: Performance can only be enhanced after measurement. A comprehensive reporting system in a collections solution will provide you with a holistic view of daily activities, payments, arrangements, and portfolio performance over time.

Collateral Management: Collateral management capabilities within a debt collections software enable you to proactively make the right decision, at the right time. These capabilities include the toolset to host all the required information in an easy-to-understand format, such as collateral types and the dynamic, housing market values.

Automated Decision Engine: Analysing data and making strategic, data-driven decisions, can consume considerable time and effort. That is why the best collection software should offer decision-making capabilities that partly automate the design of collection strategies with user-defined portfolio segmentation, classification abilities, and decision trees for informed-decision making. In addition, you can utilise it to experiment with different strategies and extracting their effectiveness in real time.

Omnichannel Customer Experience: Today's consumers expect seamless access to multiple communication channels. A built-in omnichannel solution caters to those needs, elevates their overall experience, and enhances your payment rates.

Self-Service Platform: Self-service functionality provides customers with easy, 24/7 access to information and options for payment arrangements. Similarly to omnichannel solutions, this results in increased customer satisfaction and collection rates.

System of Record: A capable collection software should offer a robust system of record for proper data storage and management. This enables efficient case management by providing organisations with an easy and centralised way to access customer information, such as collected payments, debt owed, contact information, collaterals, etc.

The ideal debt collection software should feature at the very least these essential features, which, when utilised, will lead to massive benefits for your organisation.

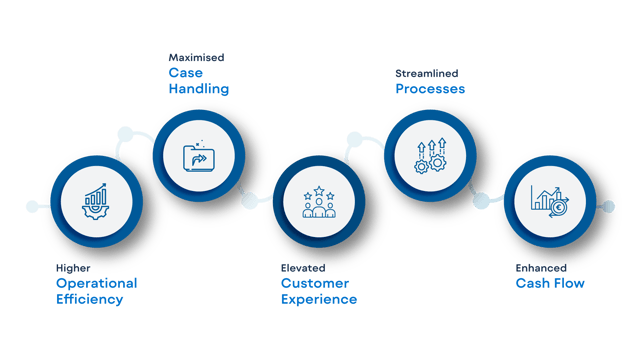

The Benefits of Utilising Collection Software

A capable debt collection software can provide a plethora of benefits to organisations. Here are the most notable ones:

Operational Efficiency: Managing collections and non-performing loans is a challenging task. Organisations often outsource some operations to third parties in an effort to maximise debt sustainability. However, outsourcing further increases complexity, as in-house and outsourced operations need to be in sync. A debt collection software can bring in-house and outsourced operations under a centralised platform, providing operational efficiency.

Maximised Case Handling: A robust collections software automates debt monitoring and execution, enabling agents to find the right data at the right time, and focus on customers, rather than repetitive tasks. Features such as dynamic restructuring and a self-service portal further increase case handling efficiency. More specifically, case studies from QUALCO Collections & Recoveries (QCR) point to threefold increase in cases handled after the implementation of collections software.

Elevated Customer Experience: Consumers expect instant access to information and services 24/7. Traditional debt collection methods cannot meet such expectations, as even the hardest working agents can’t provide non-stop, instantaneous support. A debt collection software solves that challenge by providing a self-service portal and omnichannel capabilities. This enables customers to access information and optimal solutions with their chosen communication method.

Streamlined Processes and Compliance: Debt collection involves numerous processes, from business as usual-related tasks to legal matters. Debt management solutions enable you to mitigate the complexity of such processes with automation tools and built-in compliance processes. QCR, for example, offers the Processes Module so that organisations can create, tailor and customise processes within the tool to their individual needs. When a process has been set within the software, agents can execute it with more efficiency, fewer errors, and easier legal compliance.

Enhanced Cash Flow: Debt collection software eliminates numerous manual tasks while centralising and automating certain activities. Additionally, data analytics and automated decision-making enable proactive communication with vulnerable customers who may need assistance. This results in an enhanced flow of up to 35%, as indicated by QCR customers.

Why QUALCO Collections & Recoveries

QUALCO Collections & Recoveries is a comprehensive, end-to-end debt management solution that offers all the required capabilities and the benefits associated with them. It provides scalability for organisations of all sizes, with swift portfolio onboarding, collateral management, and more.