From an operational issue to a strategic challenge: How big data shape the new landscape for NPL management

Panayis Fourniotis Pavlatos |

There is increased pressure from regulators for financial service organisations to cut their NPLs and as a result, the market for European debt is booming. Whether banks are looking to get NPLs off their books or buyers of debt are looking to maximise the return on their investment, there is an increased urgency to improve recovery rates.

Non-performing loans (NPL) have become a significant strategic challenge for many lenders.

The principal driver for this change has been pressure from financial regulators. In the long wake of the financial crisis, and charged with making the financial system more robust, they have tightened the rules governing provisioning and capital adequacy.

They have also established firm guidance as to fair treatment of customers who are in arrears. In doing so they have fuelled a strong European debt market.

Debt portfolio managers face a number of challenges in identifying the right way to:

- Get NPLs off their books.

- Improve the quality of their portfolios.

- Reduce risk exposure.

- Improve and streamline overall C&R operations.

In its 2016 European Debt Sales Report, consultants KPMG noted, “The European Central Bank’s Single Supervision Mechanism’s (SSM) top priority for 2016 is to review Business

Model and Profitability Risk. It will challenge banks to prove that they can create capital, sustainably, even in a low yield environment. It is also very concerned by high NPL ratios in several markets and is starting to push banks for reduction targets.”

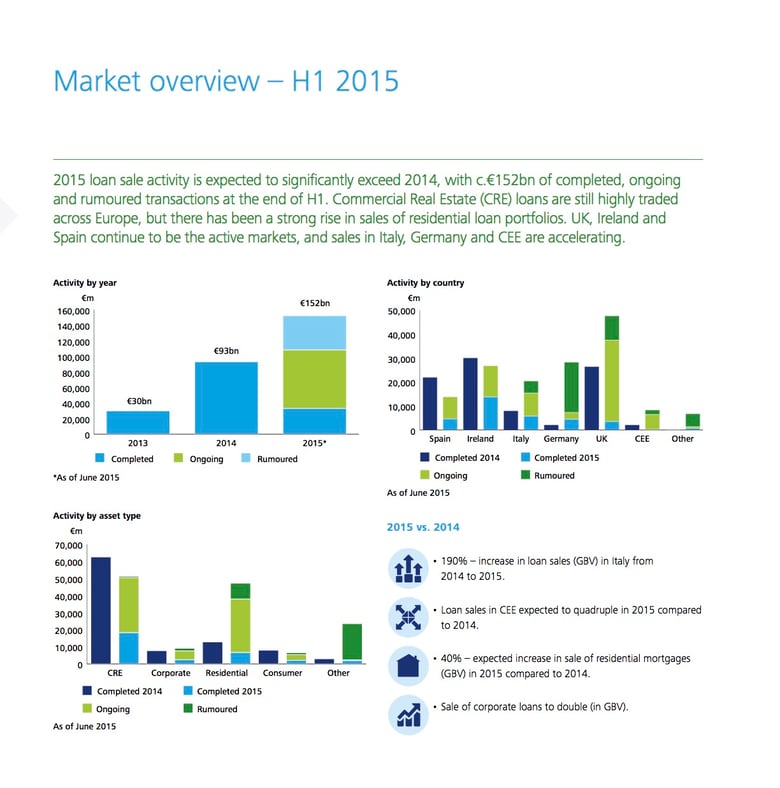

This will goad further activity in the debt market. A year earlier Deloitte had predicted that 2015 would see a 60% increase in total loan sales over the previous year.

The same report also showed that the market was being led by the UK, Germany and Ireland and that commercial and residential real estate accounted for a large proportion of market activity.

Whether you are a bank trying to clean up your portfolio or a buyer of debt, there is a strong incentive to remove NPLs. Deloitte’s research indicates over €800bn of non-performing loans reside on the balance sheets of European banks.

Debt portfolio managers face a number of challenges in identifying the right way to get NPLs off their books and improve the quality of their portfolios, thus reducing their risk exposure.

Technology now exists that can implement an end-to-end predictive analytics workflow harnessing large volumes of data, such as monthly snapshots of millions of accounts over many years. This can inform the NPL collection and recovery (C&R) process as never before.

It is now possible to segment overdue accounts in order to identify customers by the way they react to different approaches. This is a significant advance on the traditional focus on customers’ ages, gender or income group.

By establishing an infrastructure that automates data analysis, you can improve response times, create economies of scale and free up your analysts to make better, faster C&R decisions.

Takeaways:

- Automating day-to-day decision-making can help you to manage the increasing complexity of your non-performing assets.

- Data and automation enables you to plan further ahead and free up the time to allow you to make more nuanced decisions about issues such as the best way to treat your clients fairly.

- Technology can be implemented to bring data-driven decision to the business that allows prediction of factors such as contactability, restructuring success rates, recovery rates, complaints and fraud, as well as predictive evaluation of more fine-grained proposed actions.

- The debt management sector is booming, but it could be doing even better. The industry uses a lot of technology but it is not making the most of it and so it is failing to maximise returns.

To discover more, download The Debt Portfolio Blueprint: How to improve recovery rates through data-driven decisions, better segmentation, and enhanced analytics