Credit Risk Management Definition, Mitigation, and Solutions

QUALCO |

Introduction

Credit risk management for customers who may default on their loans is a complex process that involves the analysis of numerous factors, such as the customer’s capital and collateral. However, by assessing the risk, taking proactive measures, and making data-driven decisions, you can mitigate the risk of default.

In this blogpost, we will be exploring the definition of credit risk for borrowers, how to measure it, the importance of it, and how it can be mitigated with strategies and tools.

What is Credit Risk?

Credit risk in the context of loan management refers to the possibility of a customer being unable to repay a loan, which could result in a financial loss for the lender. Customers who are deemed to have a higher credit risk may have to pay higher interest rates and provide some form of collateral as a guarantee of repayment. This is a common strategy used in credit risk management.

Credit risk management involves evaluating a customer’s ability to repay a loan before granting it to them. After the loan has been granted, risk management additionally involves adjusting loan variables and taking necessary actions to maximising debt recovery.

If the credit risk is too high, lenders may choose not to provide the loan to avoid cash flow disruptions and expenses associated with debt recovery attempts. Lenders take proactive measures to seize the probability of default and to mitigate risk.

How to Measure Credit Risk

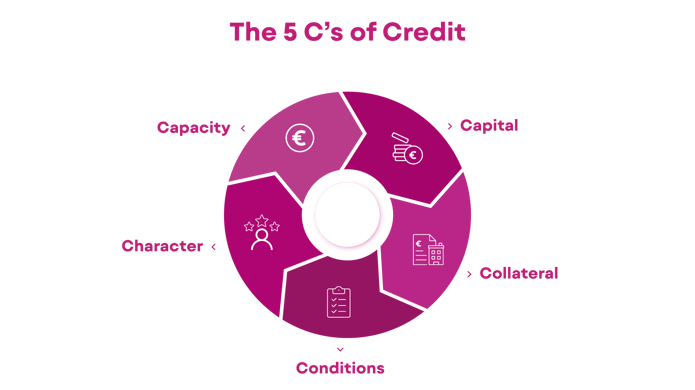

The process of measuring credit risk can vary between Individual lenders and financial institutions. Nonetheless, it is commonly performed by utilising a set of principles known as the “5 Cs of credit”. These are as follows:

- Capacity: This refers to the amount of loans the customer can obtain and repay, based on their capital, income, expenses, debt, and stability of employment.

- Capital: For individuals, capital refers to the wealth they hold, while for businesses, it refers to investments and profits. Capital can also be used as collateral.

- Character: A customer’s credit score, credit history, bast behaviours and reputation play a pivotal role in credit risk assessment.

- Conditions: This refers to the terms of the loan, the purpose of the loan, and the economic background of the customer. Different types of loans will have different conditions. For example, a loan for the purchase of a vehicle compared to one for financing the working capital of a business are under very different conditions with different aspects to be considered.

- Collateral: Collateral refers to the physical or liquid assets that a borrower pledges to secure a loan. This is done to reduce the risk of financial loss in case the borrower defaults on the loan. Collaterals are especially required in case of higher credit risk accounts. When considering collaterals, factors such as the monetary value of the asset, transfer cost, and location should be taken into account. If the collateral is a physical asset, location becomes an important consideration.

The Importance of Credit Risk Management

Effectively measuring and managing credit risk plays a pivotal role in ensuring the financial well-being of an organisation. By taking proactive and appropriate actions, risk management and mitigation strategies can boost cash flow, prevent financial losses, and heighten the organisation’s reputation.

Enhanced cash flow: Proper credit risk assessment and management helps identify creditworthy customers, resulting in higher profitability.

Financial loss prevention: Proactively identifying and managing vulnerabilities can enhance debt recovery rates, even in cases where the customer may not be able to repay a loan.

Heightened credibility: Financial institutions with strong credit risk management frameworks and successful debt collection rates have a higher chance of having a solid reputation.

Credit Risk Management and Mitigation

Credit risk is primarily assessed, managed and controlled by considering the 5 Cs of credit. However, aside from these factors, analysing data related to economic uncertainties, portfolio impacts, and using modern software can help identify creditworthy or vulnerable customers, leading to more effective credit risk assessments.

- Monitor the 5 Cs of Credit

It's important to keep a close eye on the 5Cs of credit, which include capacity, capital, character, conditions, and collateral circumstances. These factors can all change over the course of a loan's lifecycle, especially for loans with longer terms. To maintain an accurate credit risk assessment, it's crucial to consistently monitor these 5Cs. - Adapt to Economic Uncertainties

External factors, such as inflation, cost of living, the housing market, industry parameters, and supply chain disruptions, can have an impact on both businesses and consumers. These economic aspects may introduce uncertainties that are beyond anyone's control and should be taken into consideration. Even if a customer's capital, character, and conditions remain stagnant over the years, external factors may still negatively affect their capacity. In such scenarios, proactive loan restructuring can be an enormous help to a vulnerable customer. - Simulate Portfolio Impact

Taking into account both internal and external factors that can impact credit risk currently, it can be helpful to simulate potential future scenarios to obtain important data for assessing risk. This information can then be used to take proactive measures and provide assistance to customers who are most vulnerable. For instance, it is useful to consider how a portfolio may look like in 2-3 years and how this could impact customers who already have a relatively high credit risk. By doing so, we can determine the necessary steps to take to support these individuals. - Utilise Portfolio Analytics Software

Credit risk evaluation, management, and mitigation, require a significant amount of data analysis and decision-making. Nevertheless, with the help of portfolio analytics software, both of these processes can be automated and streamlined efficiently. The use of digital technology can provide you with early warning indicators for credit risk. Additionally, it is a more effective method of organising data, proactively identifying behaviours with machine learning, categorising customers based on these behaviours, simplifying communication strategies, and much more.

Why Choose QUALCO Data-Driven Decisions Engine (D3E)

QUALCO QUALCO Data-Driven Decisions Engine (D3E) is a central hub that combines credit portfolio analytics and accounts receivable analytics for efficient and automated credit risk assessments. It offers several core benefits that can help you maximise business value, including:

- Early warning indicators for credit risk: Proactively identify heightened risk indicators with the use of machine learning.

- Increased profitability: With D3E’s tailored customer treatments, you can minimise human effort and achieve a double-digit uplift in cash collections.

- Consolidated data view: Manage big data with maximum efficiency and obtain a real-time overview of your portfolio with enhanced analytical assessments.

- Cost-efficient experimentation: Build multiple models and simulate portfolio impacts in a cost-effective manner.

- Rapid deployment: Deploy swiftly in 1-4 weeks by utilising D3E’s powerful data modelling and ingestion capabilities.

- Multiple deployment options: Choose between in-house, cloud-based, or hybrid options and seamlessly integrate the platform with your existing IT architecture.