The constant rise of banking debt during the past years has steadily led to the revision of the existing Breathing Space regulation, or Debt Respite Scheme with its full name.

With the new regulation coming into force on the 4th of May, creditors need to ensure that they have all the available tools within their reach, to efficiently manage the handling of a great number of cases in a limited timeframe. An estimation of 750,000 customers are expected to use the service, but the post-Covid era might cause a significant increase.

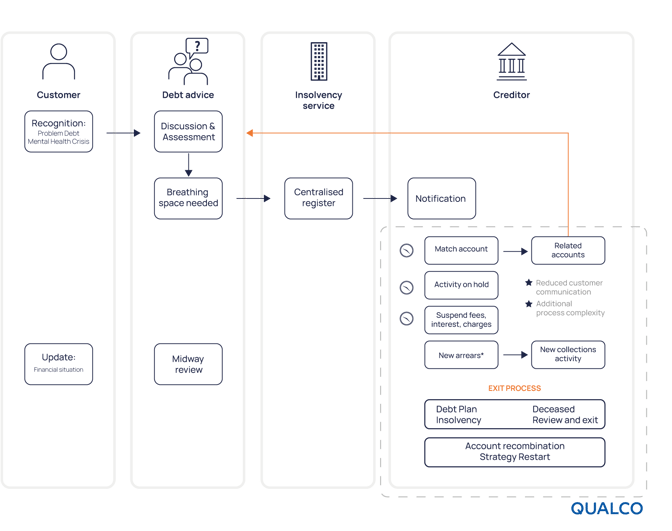

The two types of scheme that are being introduced, a programme for customers with problem debt and one for customers who are receiving mental health crisis treatment, alongside various factors further increase the level of complexity for creditors and make the timely operations-critical.

Why is that? Even though the new process appears straightforward, headwinds might appear due to the complex nature of the collections process. For example, if a customer applies for Breathing Space, the creditor must match all the customer accounts, identify if there are other accounts linked to each customer and then activate the moratorium. During the moratorium, all communications for the specific debts must pause, while upon the exit from the scheme the creditors need to adapt their strategy again according to the case so that they can proceed with the debt collection.

Activities like the mentioned above take time, but time won’t be available in this case. As soon a customer applies, all collection attempts must cease by the next working day.

In our latest report, we showcase all the implications of the new moratorium and explain how creditors can take a step forward in efficiently managing their customers’ debt through technologically advanced solutions.

Want to discover more? Click here